Become the 100% Owner of a Cash-Flowing Commercial Real Estate Property

Full Control

Done For You

The Best Deals

Let us help you

invest in the life

you actually want.

Our private family office provides exceptional investments all under contract in our name. You select the opportunity, we oversee the diligence and get you financed. You put in your capital investment and we do the rest.

Review YOUR Investment ExperienceIn Transactions Completed

Targeted Transaction Amount in 2026

Pre-vetted Investments in the Pipeline Now

Full-time specialists working for you

of Properties Generate Cash Flow Month 1

Target Cash-on-Cash Return

Target annual equity return

Target equity multiple

Past Properties

Live Deals

Closed Deals

Starbucks Coffee Company – Caro, MI

Quick Service Restaurant

Price: $2,650,000

Cap Rate: 6.02%

Cash-on-Cash: 3.7%

CubeSmart® Mini-Storage & AI Data Center, Bowling Green, OH

Storage

Absolute NNN

Price: $9,200,000

Cap Rate: 7.86%

Cash-on-Cash: 7.3%

Net Operating Income: $723,245

Beef-A-Roo, Auburn, IN

Quick Service Restaurant

Absolute NNN

Price: $2,325,000

Cap Rate: 8.35%

Net Operating Income: $194,250

The Neighborhood Clinic, Mesa, AZ

Medical Office

Absolute NNN

Price: $4,750,000

Cap Rate: 8.15%

Net Operating Income: $387,310

TD Jetset Dental, Warren, OH

Medical Office

Absolute NNN

Price: $1,300,000

Cap Rate: 8.62%

Net Operating Income: $112,000

AMA Medical, Galena, KS

Medical Office

Absolute NNN

Price: $6,090,000

Cap Rate: 8.87%

Net Operating Income: $540,000

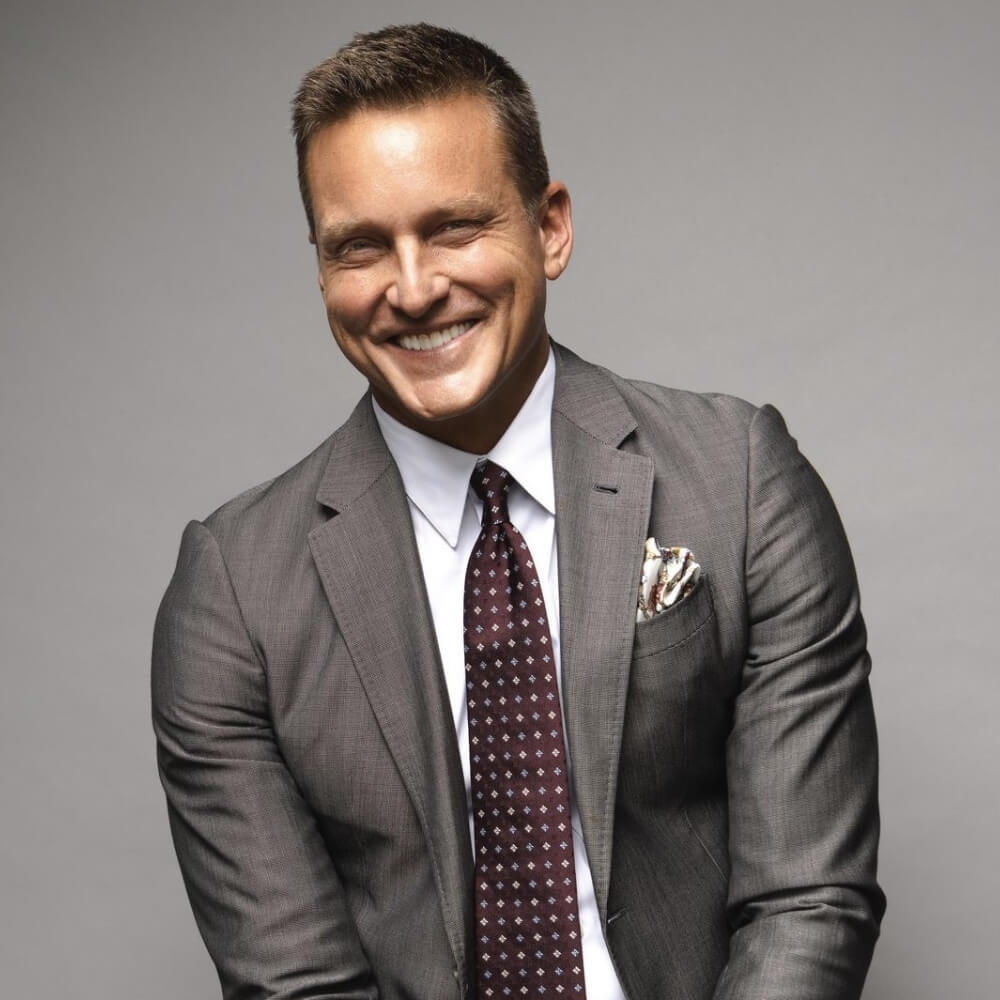

CEO

Jason Milton

I serve as CEO of Custom Capital, the commercial real estate investment firm I co-founded with my lifelong friend, Patrick Truhlar. We created a one-of-a-kind commercial real estate firm that removes all the barriers to entry for HNWI’s through our private family office commercial real estate division. We provide HNWI’s investors with pre-vetted, best in class deals, 100% ownership and zero landlord responsibilities. Simply put. We do everything for our investors, just the same way our private family office CRE team does it for us. We have created a business where there is no one in our parking space. Since launch, we’ve helped clients acquire nearly $500 million in assets across the U.S. — assets we believe are some of America’s best passive, off-market opportunities.

COO

Stephan Leccese

Stephan brings more than 20 years of experience building and scaling lending and investment platforms across private credit, real estate finance, and proptech. Throughout his career, Stephan has created and expanded platforms responsible for multiple billions in loan originations and acquisitions, while overseeing multi-billion-dollar credit portfolios through multiple market cycles. He is known for building disciplined operating models, strengthening risk and governance frameworks, and aligning underwriting, operations, and portfolio management with capital markets requirements to support liquidity, scalability, and investor confidence. In addition to his operating leadership, Stephan actively advises AI-focused companies and investment platforms developing next-generation underwriting intelligence, workflow automation, and credit-risk analytics.

Executive Chairman

Patrick Truhlar

Prior to co-founding Custom., Patrick launched and exited three financial services firms including a boutique investment banking firm, a registered investment advisory firm, and an insurance distribution platform. He’s been asked to advise a local bank as a non-statutory board adviser with seats on the credit and loan committees. He’s served as lead transaction counsel on dozens of M&As, including three Top 100 insurance firms. A former Big Six CPA with Accreditation in Business Valuation, he has a Master’s Degree in Accounting with a Specialization in Tax. He has also been an Investment Advisor Representative, a real estate broker, a mortgage broker, and amateur attorney. He reads legal documents for fun. Our Expander.

CRO

Tom Savino

Tom Savino is an ambitious, numbers-driven CRO with 20+ years of executive leadership and dynamic sales and marketing experience in the vacation ownership industry. As Senior Vice President of Sales and Marketing at Diamond Resorts, he consistently exceeded a $300+ million budget while growing the business by implementing strategic market analysis studies and expanding company reach into new national and international geographic regions. Tom is driven by his signature strategy of identifying opportunities, developing action plans, overseeing detailed executions, and producing measurable outcomes. Tom was recognized for his achievements as the leader of the most profitable region in the company exceeding 118% of budget. He was also the regional host of the Diamond Resorts Golf Tournament Charity Series benefiting Florida Children’s Hospital with millions of dollars collected in donations. In his free time, Tom is an avid golfer who can be found reading the greens on the local links.

Save Time, Money, and mistakes